Invoice Accrual Export Report

You can export a report of the invoices that haven't yet been approved for the month.

Introduction

The Invoice Accrual report shows you a list and value of the invoices and invoice lines that haven't yet been approved for the month. This gives you a value of your outstanding liability for the month of invoices that have not yet been approved, thus allowing you to accrue a value of your payable liability at the end of the month or accounting period.

Invoice Accrual Report

- This report can be exported from the Invoice Automation > Invoices menu.

- From there, click Export selected invoices and select Export accrual report from the dropdown list.

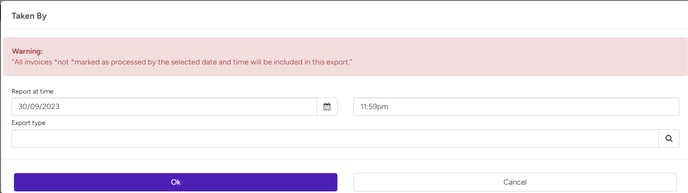

- Enter the date and time to report up to, and select the Export type.

- Click Confirm.

This creates an excel file for you, where you can obtain a total of unapproved invoices as at the date and time selected. The file contains the following columns:

|

Work Id (Branch) |

|

Creditor Code |

|

Invoice/Credit Note Number |

|

Invoice Type, I = Invoice C = Credit Note |

|

Invoice Description |

|

Status |

|

Invoice Date |

|

Payment Due Date |

|

Invoice Amount incl GST |

|

Line Item (GST exclusive Value) |

|

Project ID |

|

Cost Code |

|

Cost Type |

|

General Ledger Code |

|

GST Code |

|

GST Amount |

Need more help? We’re here! We hope our article was helpful! If you need more info or want to connect, drop us an email at support@lentune.com.

Thank you. We love to hear from you!

Last updated: 3 September 2023