Supplier with no Tax on their invoices

Setting up a Supplier where there is no GST / Tax on their invoices.

Introduction

Where you have Suppliers overseas, the invoices you receive from them may be exempt from GST / Tax.

If that is the case, you can set up the Supplier so the correct Tax Code will be applied to their incoming invoices so you will not have to update it on their invoices.

You can also set the Invoice Primary Tax Source in the Administration Settings to determine the priority for applying the Tax Code.

Invoice Primary Tax Source Setting

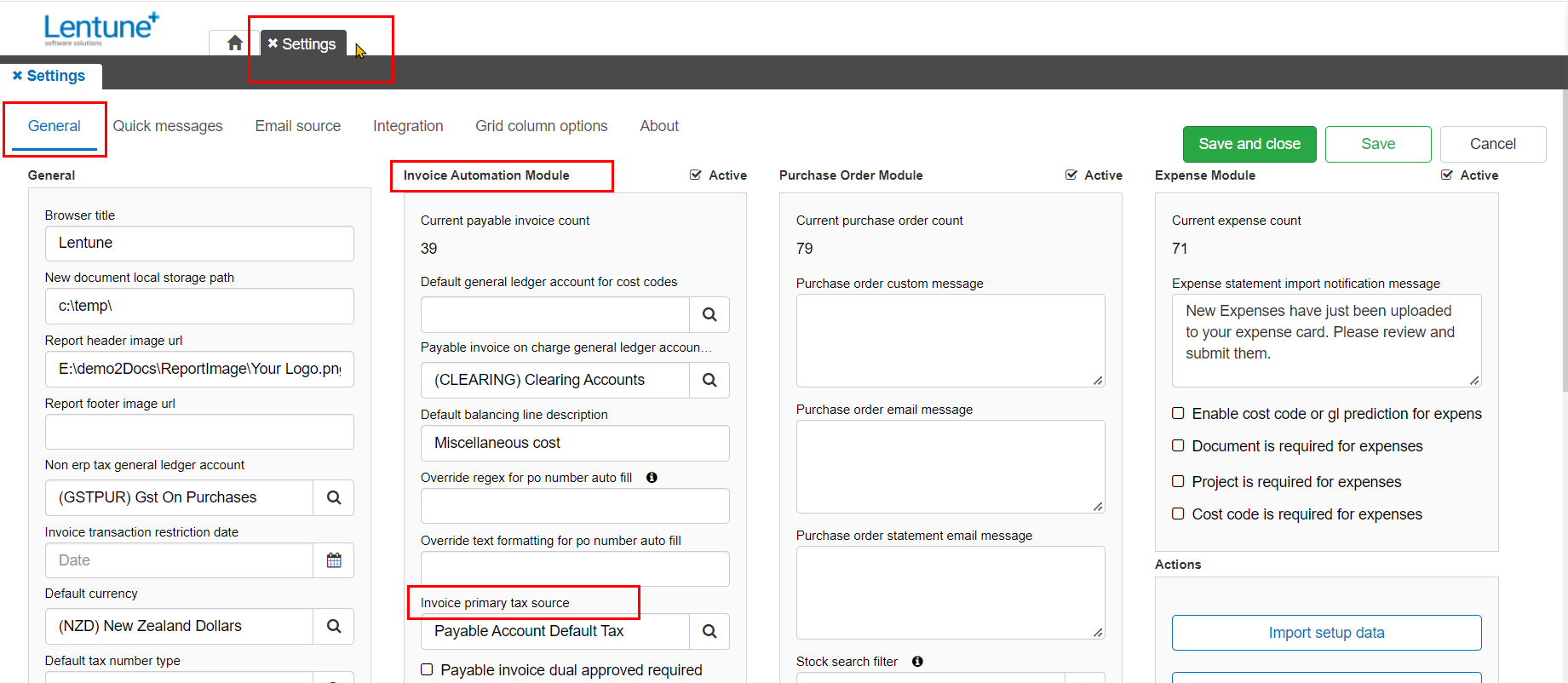

To check or change the setting for the Invoice Primary Tax Source:

- Go to Administration > Settings.

On the General tab > Invoice Automation Module section, the selections for Invoice Primary Tax Source are:

- Default: Select this option for the standard default positions to determine which Tax code is used on an invoice. The priority is:

- If there is a General Ledger code used on the invoice, and the GL code has a Tax code, then that Tax code will be used.

- If there is no Tax code on the GL code, then the Tax code on the Account Type for the Payable Account will be used.

- If there is no Tax code for the Account Type for the Payable Account, then the Tax code on the Payable Manager > Account Group > Account Type will be used.

- Payable Account default tax. Select this option to always use the Tax Code for the Payable Account. This will override the Tax Code on the General Ledger code that is used on an invoice.

- Payable Account Default Tax With No Tax. Select this option if you always want to use the Tax Code that is on the Account Type for the Account Payable. We suggest to use this where you have some Suppliers that send invoices with NO Tax / GST.

-

Payable Account Default Tax With No Tax. Select this option to always use the Tax Code with a zero tax rate from the Account Type for the Account Payable as the priority selection. (If the Tax Code on the Account Payable has a tax rate that is more than 0%, it will not be used.) For example, you can set up an Account Type for Zero Tax, and your Accounts Payable e.g. for overseas invoices, that have no tax should belong to this Account Type. You can have other Account Types with the appropriate Tax codes for standard Accounts Payable. Use this where you have some Suppliers that send invoices with NO Tax / GST.

Tip: You can set up Account Types with the required Tax Codes and percentages in Administration > Account Types.

Payable Account Tax Code

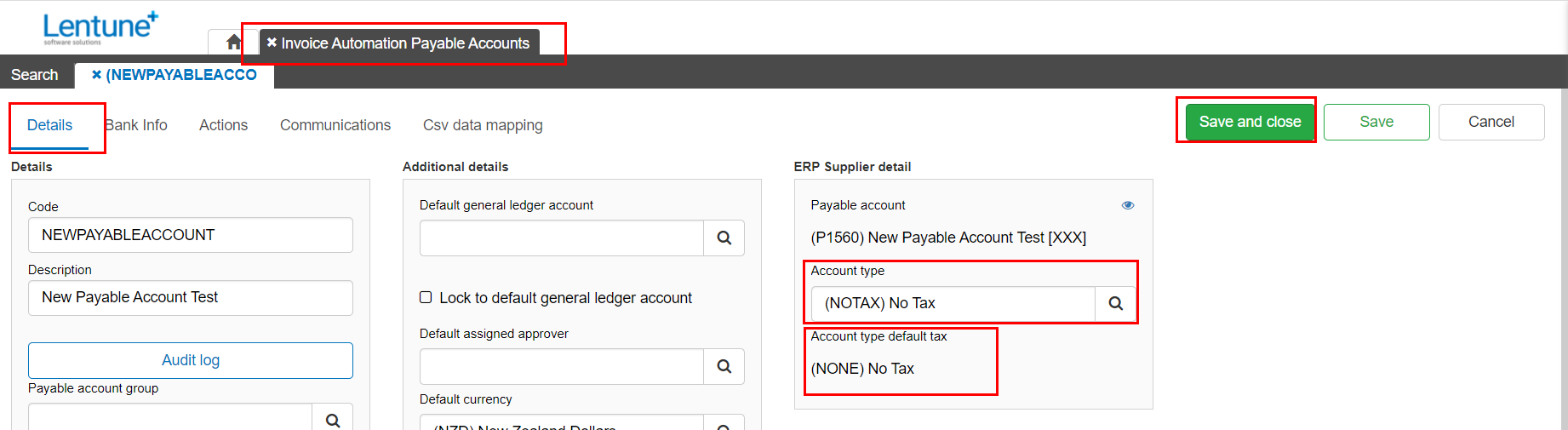

To ensure the correct code is attached to the Payable Account:

- Go to Administration > Payables.

- Select the Payable Account you wish to check or edit.

In the field Account Type:

- Select the Account Type that uses the required Tax code, e.g. NO TAX. The default Tax Code for that Account Type will display below this field.

- Click Save and Close.

Was this helpful? If you require further assistance, or would like to contact us about this article, please email us at support@lentune.com.

Thank you. Your feedback is appreciated.

Last updated: 17 February 2022